Financial Close Management Software Market Size 2023 to 2032

The financial close process is an accounting procedure that is conducted at the end of the month to close out the current period. Financial close management is a recurring process in management accounting by which accounting teams check and adjust account balances at the end of a particular period to produce precise financial reports. Financial close management software provides standardize and organized automated process to reduce the manual work and enhance the preciseness of the financial report. Financial close management software helps in financial consolidation, account reconciliation, budgeting and forecasting, tax provisioning, data loading and mapping, and others.

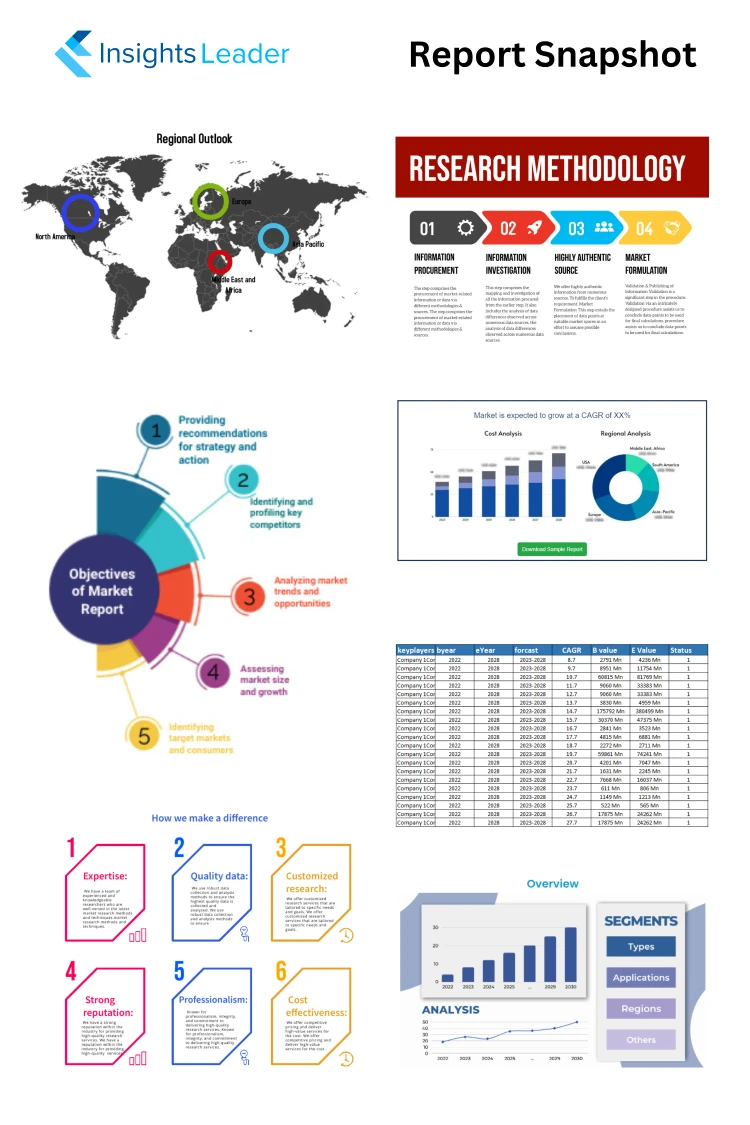

Report ID : IL_1230 | Report Language's : En/Jp/Fr/De | Publisher : IL |

Format :

Financial Close Management Software Market Report Overview 2032:

The financial close process is an accounting procedure that is conducted at the end of the month to close out the current period. Financial close management is a recurring process in management accounting by which accounting teams check and adjust account balances at the end of a particular period to produce precise financial reports. Financial close management software provides standardize and organized automated process to reduce the manual work and enhance the preciseness of the financial report. Financial close management software helps in financial consolidation, account reconciliation, budgeting and forecasting, tax provisioning, data loading and mapping, and others.

Financial Close Management Software Market Size was valued at US$ 5,494.27 Mn in 2023, and is projected to reach US$ 13,631.77 Mn by 2032, growing at a CAGR of 12.3% from 2023 to 2032.

The Financial Close Management Software market has witnessed remarkable growth in recent years, driven by technological advancements. This market research report provides a comprehensive analysis of the Financial Close Management Software market, including current trends, key drivers and challenges, market segmentation, and a detailed forecast for the upcoming years. The report aims to assist industry stakeholders, investors, and decision-makers in understanding the market dynamics and formulating effective strategies for sustainable growth in this rapidly evolving sector.

Drivers

Increasing adoption of cloud-based technologies is driving the growth of financial close management software market

The rising adoption of cloud-based technologies is promoting the growth of financial close management software market. Additionally, increasing technological advancements including artificial intelligence is propelling the growth of financial close management software market.

The Financial Close Management Software market has experienced robust growth in recent years, and this trend is expected to continue in the foreseeable future.

The research report on the Financial Close Management Software market utilizes a strategic market segmentation approach to gain a comprehensive overview of the industry. The segmentation is based on product type, application, end-user, and geographical region. By categorizing the market into distinct segments, such as different geographical regions, this report offers valuable insights into the market dynamics, customer preferences, and growth opportunities. The segmentation analysis enables businesses to identify target markets, tailor their strategies, and capitalize on emerging trends within the Financial Close Management Software industry.

Overview of Key Industry Players

The Key Players section of a market research report offers a comprehensive introduction to the major companies operating in the market. This section provides valuable insights into the key players profiles, including their backgrounds, business overviews, and key highlights. It highlights the prominent market players who hold significant market shares and influence the industry dynamics.

The major players in the market are:

IBM

SAP

Oracle

Planful

DataRails

FloQast

Trintech

Vena Solutions

insightsoftware

BlackLine Inc.

Market Trends Insights:

– The Financial Close Management Software market research report emphasizes several notable market trends.

– Ongoing transformation is revolutionizing the current business landscape.

– The adoption of advanced technologies is widespread, changing how businesses operate, formulate policies, and interact with customers.

– Financial Close Management Software Market trends are exerting a significant impact on the strategies and decision-making processes of businesses in various sectors.

– These trends present both challenges and opportunities for market players.

– The report includes in-depth analysis of current and upcoming future trends, supported by comprehensive data.

By categorizing the market into segments:

Deployment

Cloud

On-Premises

Enterprise Size

Large Enterprise

Small and Medium Enterprise

Application

Financial Consolidation

Account Reconciliation

Data Loading and Mapping

Budgeting and Forecasting

Others

End User

BFSI

Healthcare

Manufacturing

Retail

IT and Telecommunication

Others

Key questions answered by this Financial Close Management Software Market Research Report:

1) What is the current size and projected growth of the market?

2) What are the market trends and dynamics influencing the industry?

3) Who are the major competitors in the Financial Close Management Software market and what are their market shares?

4) What are the key customer segments and their preferences?

5) What are the drivers and barriers to market growth?

6) What are the emerging market opportunities and potential risks?

7) What are the pricing trends and strategies in the market?

8) What are the regulatory and legal considerations impacting the industry?

9) What are the technological advancements shaping the Financial Close Management Software market?

10) What are the key marketing and distribution channels used in the industry?

Regional Analysis for Financial Close Management Software Market:

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, and Italy)

Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

South America (Brazil, Argentina, Colombia, etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

The Financial Close Management Software Market report includes a detailed regional analysis that provides a comprehensive understanding of market dynamics and trends across different geographic areas. The regional analysis focuses on key regions or countries, examining factors such as market size, market growth rate, market share, consumer behavior, and the competitive landscape within each region.

The regional analysis allows stakeholders to identify regional market potential and growth opportunities. It helps them understand the unique characteristics and preferences in different regions, this report also helps to target specific regional markets effectively. By recognizing regional variations in demand, purchasing power, and cultural nuances, stakeholders can make informed decisions about market entry, expansion, and resource allocation.

Additionally, the regional analysis provides insights into the competitive landscape within each region. It identifies major players, their market shares, and their strategies. This information helps stakeholders assess the competitive intensity and dynamics specific to each region, enabling them to develop competitive strategies that are tailored to the local market conditions.

Furthermore, the regional analysis highlights any regulatory, economic, or social factors that may impact the market within each region. It helps stakeholders understand the regional variations in regulatory frameworks, industry standards, and market entry barriers. This knowledge allows stakeholders to navigate the regional landscape effectively, adapt their business practices, and comply with local regulations.

By addressing these key questions, this market research report provides valuable insights and actionable information to make informed decisions, develop effective strategies, and navigate the market successfully.

This report offers key benefits for stakeholders:

1) Informed Decision-Making:

Financial Close Management Software Market research reports provide stakeholders with comprehensive and accurate information about the market, including industry trends, competitor analysis, customer preferences, and market dynamics. This enables stakeholders to make well-informed decisions based on reliable data and insights, reducing the risk of making costly mistakes.

2) Market Opportunities:

By analyzing this report, stakeholders can identify emerging trends, niche markets, and untapped opportunities. These reports provide valuable information on consumer demands, market gaps, and potential areas for growth, allowing stakeholders to develop strategies to capitalize on these opportunities and gain a competitive edge.

3) Risk Mitigation:

This research report helps stakeholders to assess market risks and potential challenges. By understanding the market landscape, including competitor strategies, regulatory changes, and economic factors, stakeholders can proactively identify and mitigate potential risks. This enables them to adapt their business plans, develop contingency measures, and minimize the impact of unforeseen events.

4) Customer Insights:

Financial Close Management Software Market reports provide valuable insights into customer behavior, preferences, and needs. By understanding their target audience better, stakeholders can tailor their products, services, and marketing strategies to meet customer expectations effectively. This enhances customer satisfaction, fosters brand loyalty, and drives business growth.

5) Competitive Advantage:

Accessing market research reports gives stakeholders a competitive advantage by understanding the strengths and weaknesses of their competitors. These reports provide valuable information on market share, product offerings, pricing strategies, and customer perception. Armed with this knowledge, stakeholders can develop strategies to differentiate themselves, improve their products or services, and effectively position themselves in the market.

6) Long-term Planning:

Market research reports help stakeholders in long-term planning and forecasting. By analyzing historical data, market trends, and future projections, stakeholders can make informed decisions regarding investment, expansion, product development, and market entry strategies. This enables them to align their business goals with market realities and plan for sustainable growth.

Overall, the Financial Close Management Software Market research reports empower stakeholders with valuable insights and data-driven information, enabling them to make informed decisions, identify market opportunities, mitigate risks, and gain a competitive edge in the ever-evolving business landscape.

Note: Our services encompass tailor-made reports that cater to our customers specific needs. Additionally, we grant customization options for reports at both regional and country levels. To ensure utmost accuracy in market forecasting, each report is diligently updated before delivery, meticulously considering the global and regional impacts of COVID-19, as well as the Russia-Ukraine crises.