Online Loans Market Size 2024 to 2031

Growing adaptability towards digital media and handheld devices including smartphones, tablets, and others is driving the market growth for Online loans, Digital media is playing a rapid role in sanctioning and acquiring loans online. The advent of technology and increasing applications of electronic devices including smartphones have been driving the market growth for the online loans market.

Report ID : IL_501 | Report Language's : En/Jp/Fr/De | Publisher : IL |

Format :

Industry Overview:

Online loans are personal unsecured installment loans offered by online lenders and some traditional banks. From lines of credit to cash advances, credit comes in all different shapes and sizes depending on the lender and needs of the borrowers. Online loan offers are disclosed based on loan’s APR (annual percentage rate), the term, and any fees, such as finance charges.

Online Loans Market Size was valued at US$ 3,794.67 Mn in 2023, and is projected to reach US$ 10,230.92 Mn by 2031, growing at a CAGR of 13.5% from 2024 to 2031.

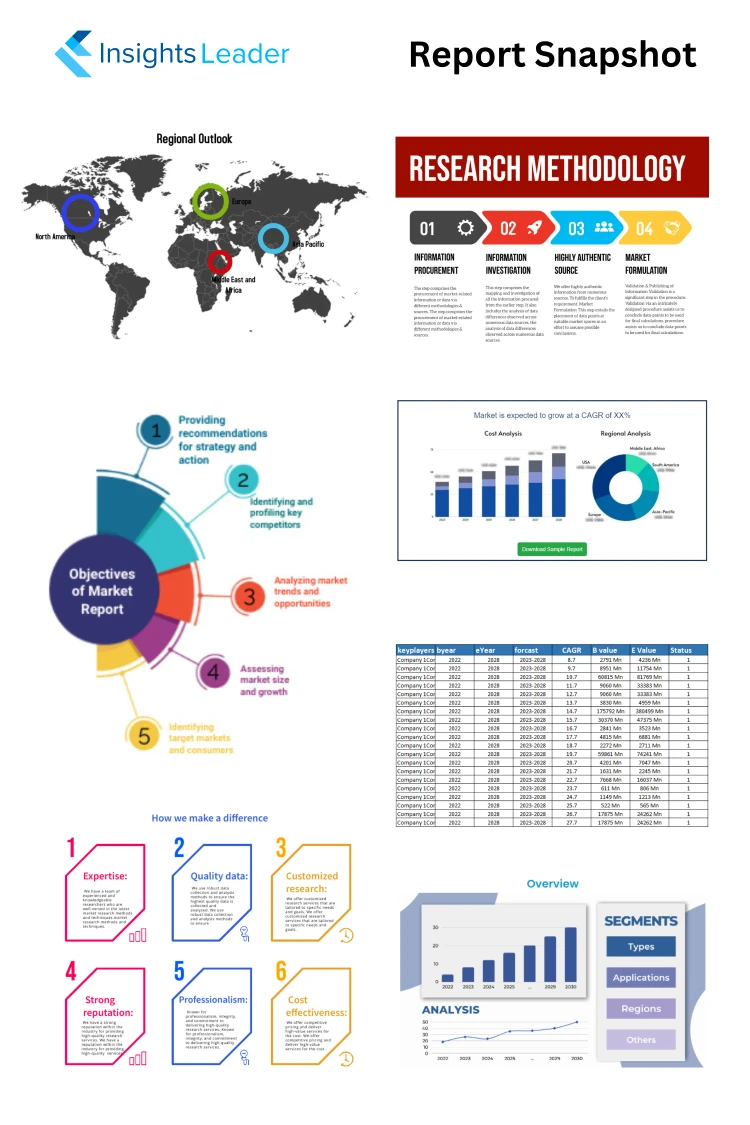

The Online Loans market has witnessed remarkable growth in recent years, driven by technological advancements. This market research report provides a comprehensive analysis of the Online Loans market, including current trends, key drivers and challenges, market segmentation, and a detailed forecast for the upcoming years. The report aims to assist industry stakeholders, investors, and decision-makers in understanding the market dynamics and formulating effective strategies for sustainable growth in this rapidly evolving sector.

Drivers

Growing adaptability towards digital media and handheld devices including smartphones, tablets, and others is driving the market growth for Online loans, Digital media is playing a rapid role in sanctioning and acquiring loans online. The advent of technology and increasing applications of electronic devices including smartphones have been driving the market growth for the online loans market.

The Online Loans market has experienced robust growth in recent years, and this trend is expected to continue in the foreseeable future.

The research report on the Online Loans market utilizes a strategic market segmentation approach to gain a comprehensive overview of the industry. The segmentation is based on product type, application, end-user, and geographical region. By categorizing the market into distinct segments, such as different geographical regions, this report offers valuable insights into the market dynamics, customer preferences, and growth opportunities. The segmentation analysis enables businesses to identify target markets, tailor their strategies, and capitalize on emerging trends within the Online Loans industry.

Overview of Key Industry Players

The Key Players section of a market research report offers a comprehensive introduction to the major companies operating in the market. This section provides valuable insights into the key players profiles, including their backgrounds, business overviews, and key highlights. It highlights the prominent market players who hold significant market shares and influence the industry dynamics.

The major players in the market are:

LightStream, Marcus by Goldman Sachs, LendingPoint LLC, Opportunity Financial, LLC, Upgrade, Inc., Universal Credit, Inc., Discover Bank, Upstart, Avant, Fiserv, FIS, Mortgage Technology, Roostify, FlexMoney (Canada), Sympleloans(Canada), Social Finance, Inc.

Market Trends Insights:

The Online Loans market research report highlights several noteworthy market trends that are shaping the current business landscape. transformation continues to revolutionize the market. The widespread adoption of advanced technologies has transformed the way businesses operate, make policies, interact with customers, etc. These market trends are significantly influencing the strategies and decision-making processes of businesses across diverse sectors, presenting both challenges and opportunities for market players. this report consists in-depth analysis of current and upcoming future trends with all data.

By categorizing the market into segments:

By Type

Installment Loan

Payday Loan

Personal Loan

Home Loan

Auto Loan

Debt Consolidation Loan

By Lender Type

Tribal Lender

Payday Loan Provider

Loan Matching Services

Offshore Loan Provider

By End User

Businesses

– Banks

– FIs

– NBFCs

Individuals

Regional Insights:

The Online Loans Market report includes a detailed regional analysis that provides a comprehensive understanding of market dynamics and trends across different geographic areas. The regional analysis focuses on key regions or countries, examining factors such as market size, market growth rate, market share, consumer behavior, and the competitive landscape within each region.

The regional analysis allows stakeholders to identify regional market potential and growth opportunities. It helps them understand the unique characteristics and preferences in different regions, this report also helps to target specific regional markets effectively. By recognizing regional variations in demand, purchasing power, and cultural nuances, stakeholders can make informed decisions about market entry, expansion, and resource allocation.

Additionally, the regional analysis provides insights into the competitive landscape within each region. It identifies major players, their market shares, and their strategies. This information helps stakeholders assess the competitive intensity and dynamics specific to each region, enabling them to develop competitive strategies that are tailored to the local market conditions.

Furthermore, the regional analysis highlights any regulatory, economic, or social factors that may impact the market within each region. It helps stakeholders understand the regional variations in regulatory frameworks, industry standards, and market entry barriers. This knowledge allows stakeholders to navigate the regional landscape effectively, adapt their business practices, and comply with local regulations.

By addressing these key questions, this market research report provides valuable insights and actionable information to make informed decisions, develop effective strategies, and navigate the market successfully.

This report offers key benefits for stakeholders:

1) Informed Decision-Making:

Online Loans Market research reports provide stakeholders with comprehensive and accurate information about the market, including industry trends, competitor analysis, customer preferences, and market dynamics. This enables stakeholders to make well-informed decisions based on reliable data and insights, reducing the risk of making costly mistakes.

2) Market Opportunities:

By analyzing this report, stakeholders can identify emerging trends, niche markets, and untapped opportunities. These reports provide valuable information on consumer demands, market gaps, and potential areas for growth, allowing stakeholders to develop strategies to capitalize on these opportunities and gain a competitive edge.

3) Risk Mitigation:

This research report helps stakeholders to assess market risks and potential challenges. By understanding the market landscape, including competitor strategies, regulatory changes, and economic factors, stakeholders can proactively identify and mitigate potential risks. This enables them to adapt their business plans, develop contingency measures, and minimize the impact of unforeseen events.

4) Customer Insights:

Online Loans Market reports provide valuable insights into customer behavior, preferences, and needs. By understanding their target audience better, stakeholders can tailor their products, services, and marketing strategies to meet customer expectations effectively. This enhances customer satisfaction, fosters brand loyalty, and drives business growth.

5) Competitive Advantage:

Accessing market research reports gives stakeholders a competitive advantage by understanding the strengths and weaknesses of their competitors. These reports provide valuable information on market share, product offerings, pricing strategies, and customer perception. Armed with this knowledge, stakeholders can develop strategies to differentiate themselves, improve their products or services, and effectively position themselves in the market.

6) Long-term Planning:

Market research reports help stakeholders in long-term planning and forecasting. By analyzing historical data, market trends, and future projections, stakeholders can make informed decisions regarding investment, expansion, product development, and market entry strategies. This enables them to align their business goals with market realities and plan for sustainable growth.

Overall, the Online Loans Market research reports empower stakeholders with valuable insights and data-driven information, enabling them to make informed decisions, identify market opportunities, mitigate risks, and gain a competitive edge in the ever-evolving business landscape.

Key questions answered by this Online Loans Market Research Report:

1) What is the current size and projected growth of the market?

2) What are the market trends and dynamics influencing the industry?

3) Who are the major competitors in the market and what are their market shares?

4) What are the key customer segments and their preferences?

5) What are the drivers and barriers to market growth?

6) What are the emerging market opportunities and potential risks?

7) What are the pricing trends and strategies in the market?

8) What are the regulatory and legal considerations impacting the industry?

9) What are the technological advancements shaping the market?

10) What are the key marketing and distribution channels used in the industry?