Insurance Telematics Market Size 2024 to 2031

Ability of insurance companies to assess risk more accurately through insurance telematics is driving the market growth Telematics data allows insurers to tailor insurance premiums to individuals drivers based on the actual driving behavior. Safer drivers receive lower premiums, while riskier drivers pay higher rates. The personalized pricing model is attractive to consumers and encourages safer driving habits. Additionally, insurance companies use telematics data to better predict and manage claims. By identifying high-risk behaviors and intervening proactively, insurers reduce the frequency and severity of accidents, leading to lower loss ratios and improved profitability.

ID : IL_1345 | Language's : En/Jp/Fr/De | Publisher : IL |

Format : ![]()

![]()

![]()

![]()

- Introduction

- Market Introduction

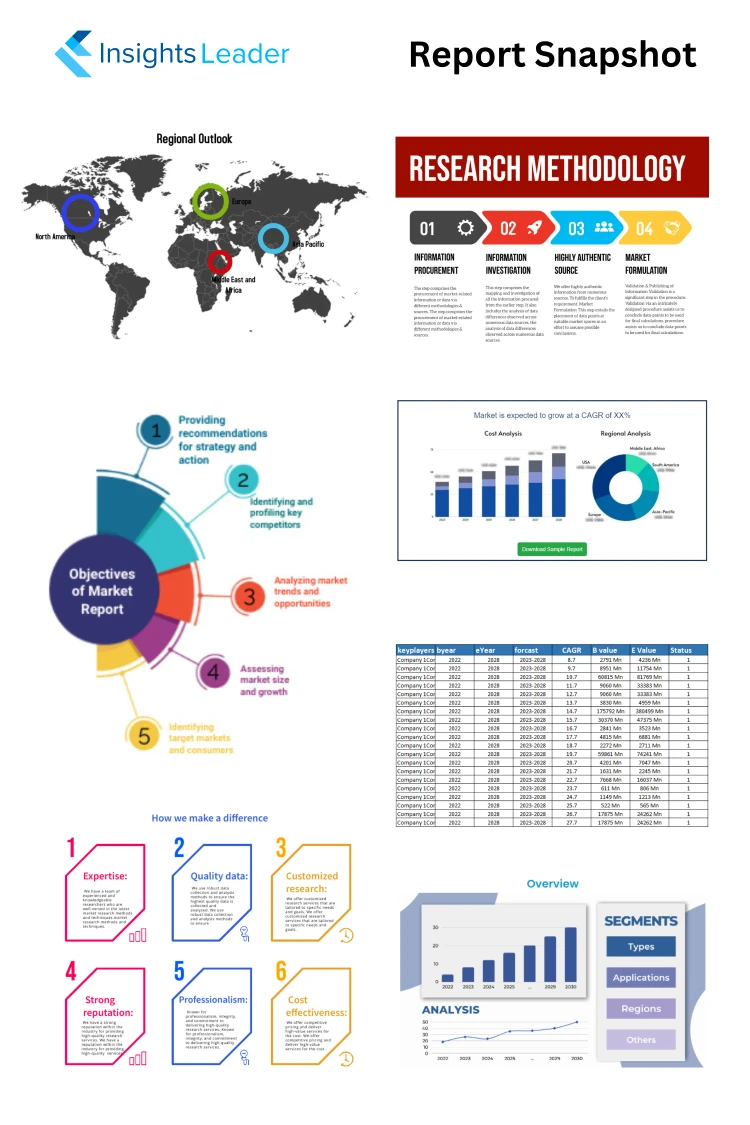

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Product Picture of Insurance Telematics

- Years Considered for the Study

- Parent Market Overview

- Overall Insurance Telematics Market Regional Demand

- Data Source

- Secondary Sources

- Primary Sources

- Executive Summary

- Business Trends

- Regional Trends

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunities

- Impact Forces During the Forecast Years

- Industry Value Chain

- Upstream Analysis

- Downstream Analysis

- Marketing & Distribution Channel

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Key Technology Landscape

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factors

- Social Factors

- Technological Factors

- Environmental Factors

- Legal Factors

- Drivers

- Global Insurance Telematics Market Segmentation, by Revenue (USD Million), (2024-2030)

- Global Insurance Telematics Market Overview, By Region

- North America Insurance Telematics Market Revenue (USD Million), by Countries, (2024-2030)

- U.S.

- Canada

- Mexico

- Europe Insurance Telematics Market Revenue (USD Million), by Countries, (2024-2030)

- Germany

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Insurance Telematics Market Revenue (USD Million), by Countries, (2024-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- Latin America Insurance Telematics Market Revenue (USD Million), by Countries, (2024-2030)

- Brazil

- Argentina

- Chile

- Middle East and Africa Insurance Telematics Market Revenue (USD Million), by Countries, (2024-2030)

- GCC

- Turkey

- South Africa

- North America Insurance Telematics Market Revenue (USD Million), by Countries, (2024-2030)

- Competitive Analysis

- Insurance Telematics Market

- Business Overview

- Business Financials (USD Million)

- Product Category, Type, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- SWOT Analysis

- Insurance Telematics Market

- Market Research Findings & Conclusion